The Definitive Online Course for Mastering ASC 230 & Manufacturing Cash-Flow Statements

Produce audit-ready cash-flow statements without endless spreadsheet headaches.

Learn to Classify, Reconcile, and Present Cash Flows That Satisfy ASC 230 and Impress Auditors!

CLICK BELOW TO WATCH FIRST!

4.9/5 star reviews

Thousands of happy customers worldwide

AS SEEN ON

Discover Why Accurate Cash-Flow Reporting Is Mission-Critical for Manufacturing Success

Does this sound like you?

Hours wasted reconciling cash-flow data every close.

Frequent audit adjustments from misclassified activities.

Uncertainty between operating and investing cash flows for PP&E.

Error-prone spreadsheets with version-control chaos.

Late financial statements due to lack of a repeatable SOP.

Deploy our proven cash-flow mapping template.

Master classification rules for all manufacturing transactions.

Automate reconciliations with smart Excel macros.

Cut close time from 10 days to 5 with a solid SOP.

Pass audits with zero cash-flow reclassifications.

What You Will Get in This Course

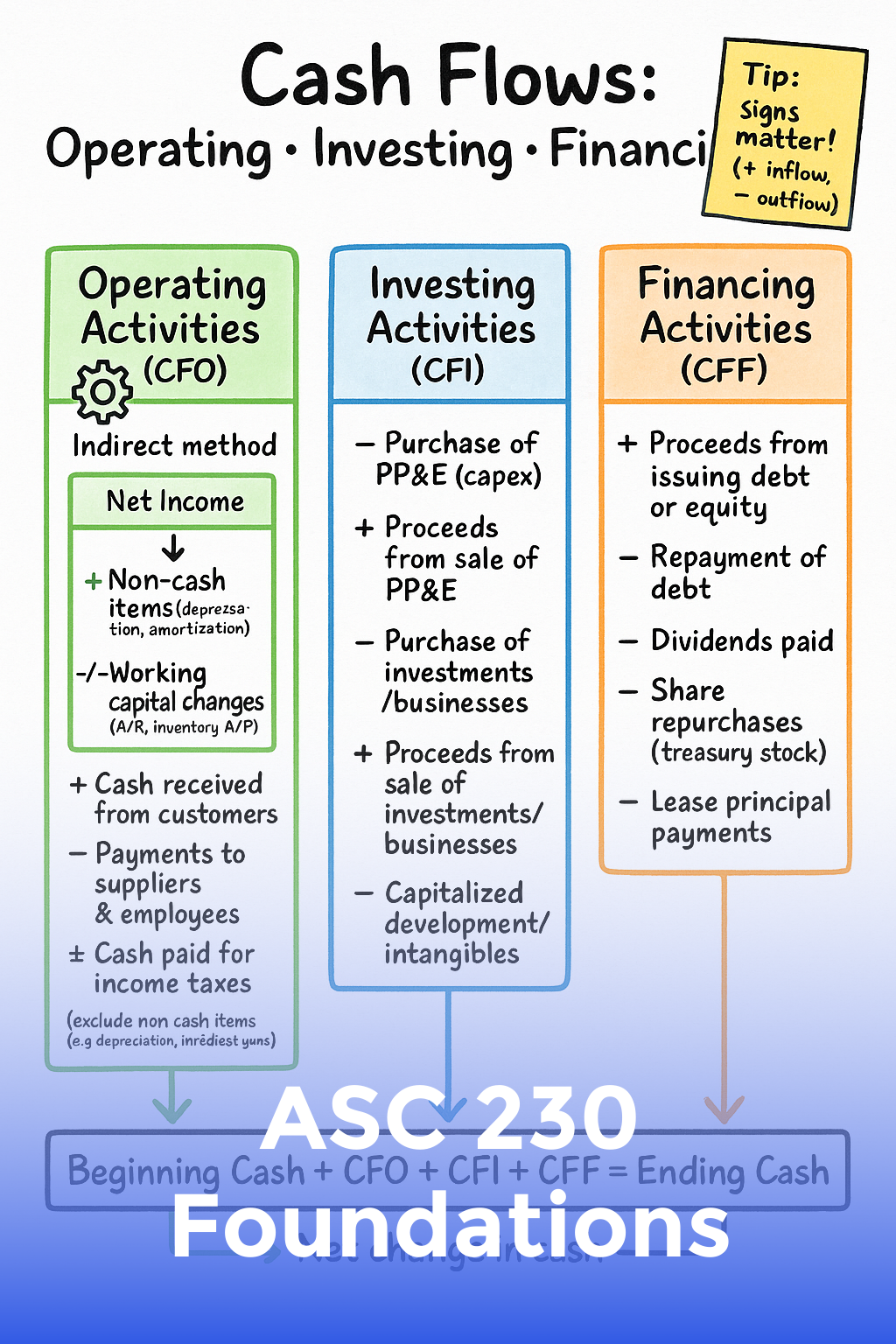

ASC 230 Foundations

Grasp ASC 230 fundamentals and the three activity categories with manufacturing-specific examples.

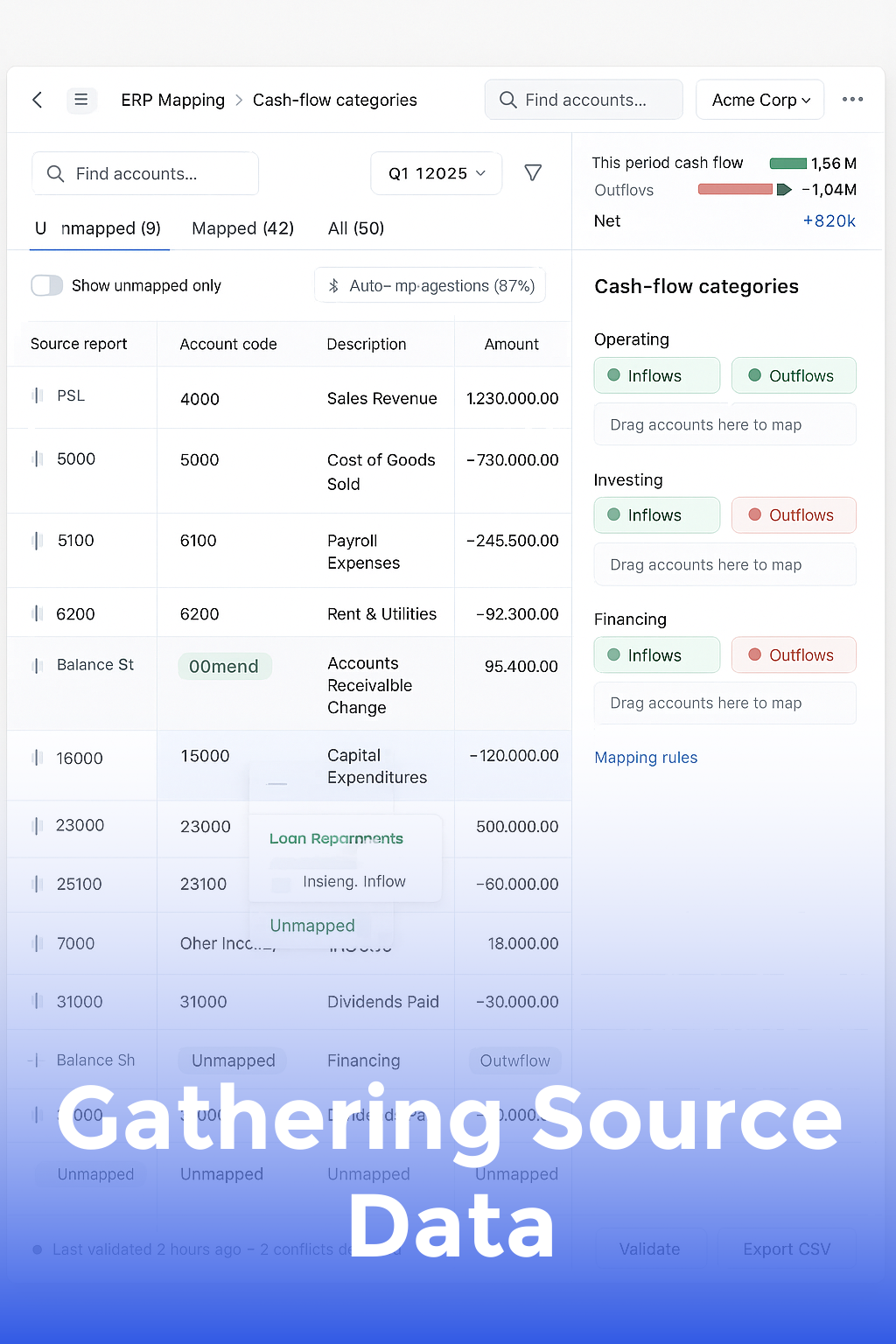

Gathering Source Data

Extract and map data from ERP systems such as SAP and Oracle for cash-flow preparation.

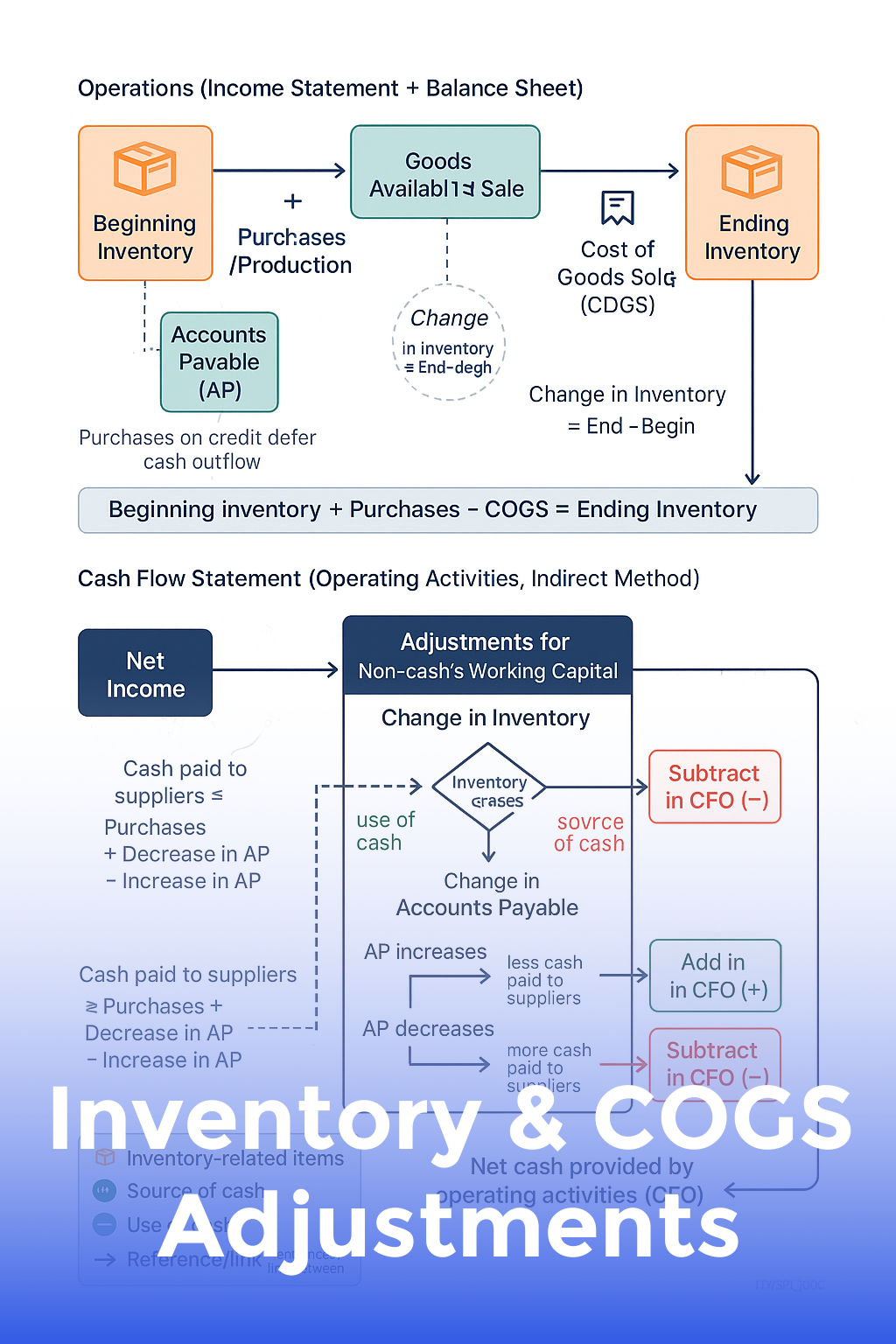

Inventory & COGS Adjustments

Reconcile inventory, depreciation, and cost-of-goods-sold adjustments unique to manufacturers.

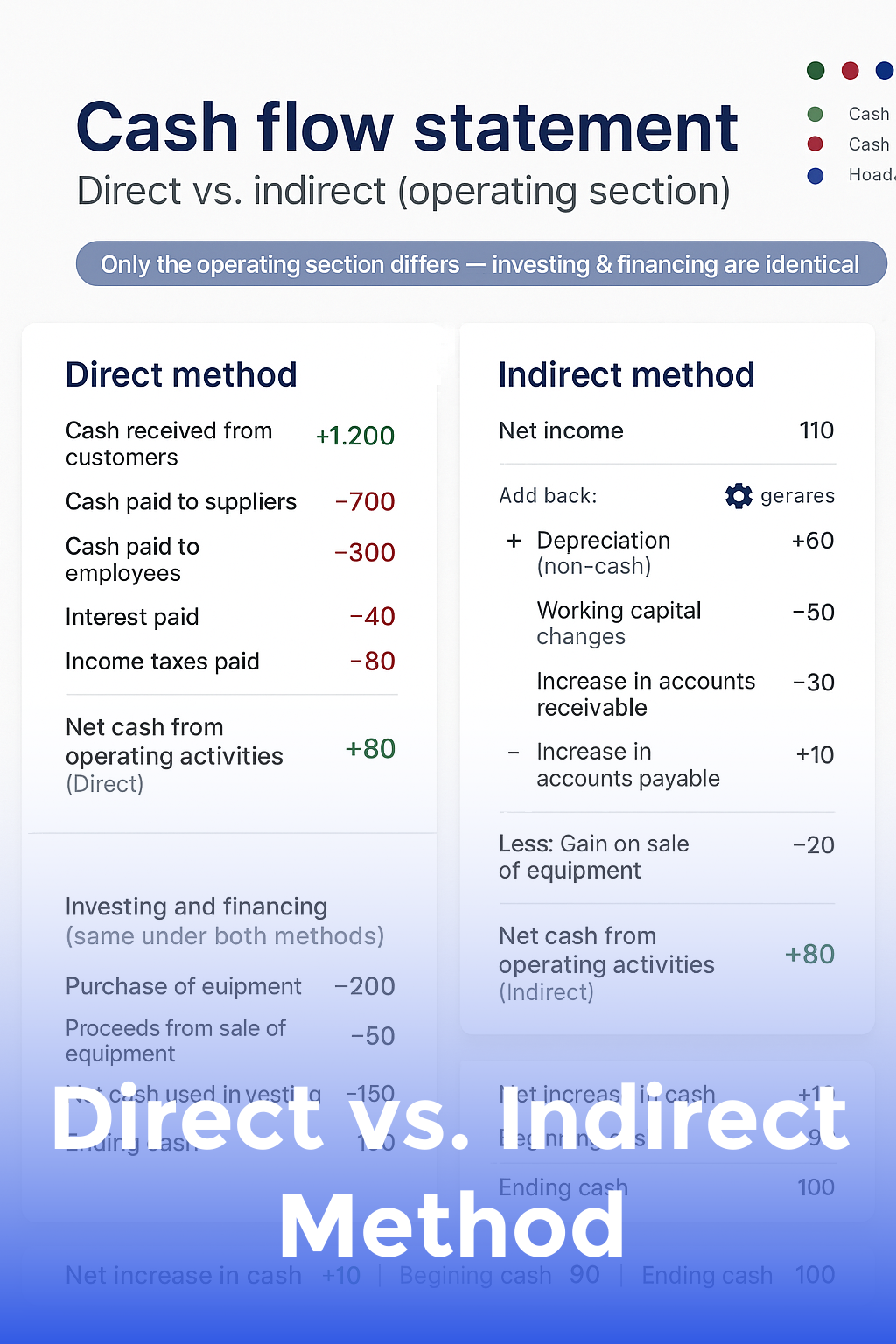

Direct vs. Indirect Method

Compare the direct and indirect methods and convert indirect data into a direct-method statement.

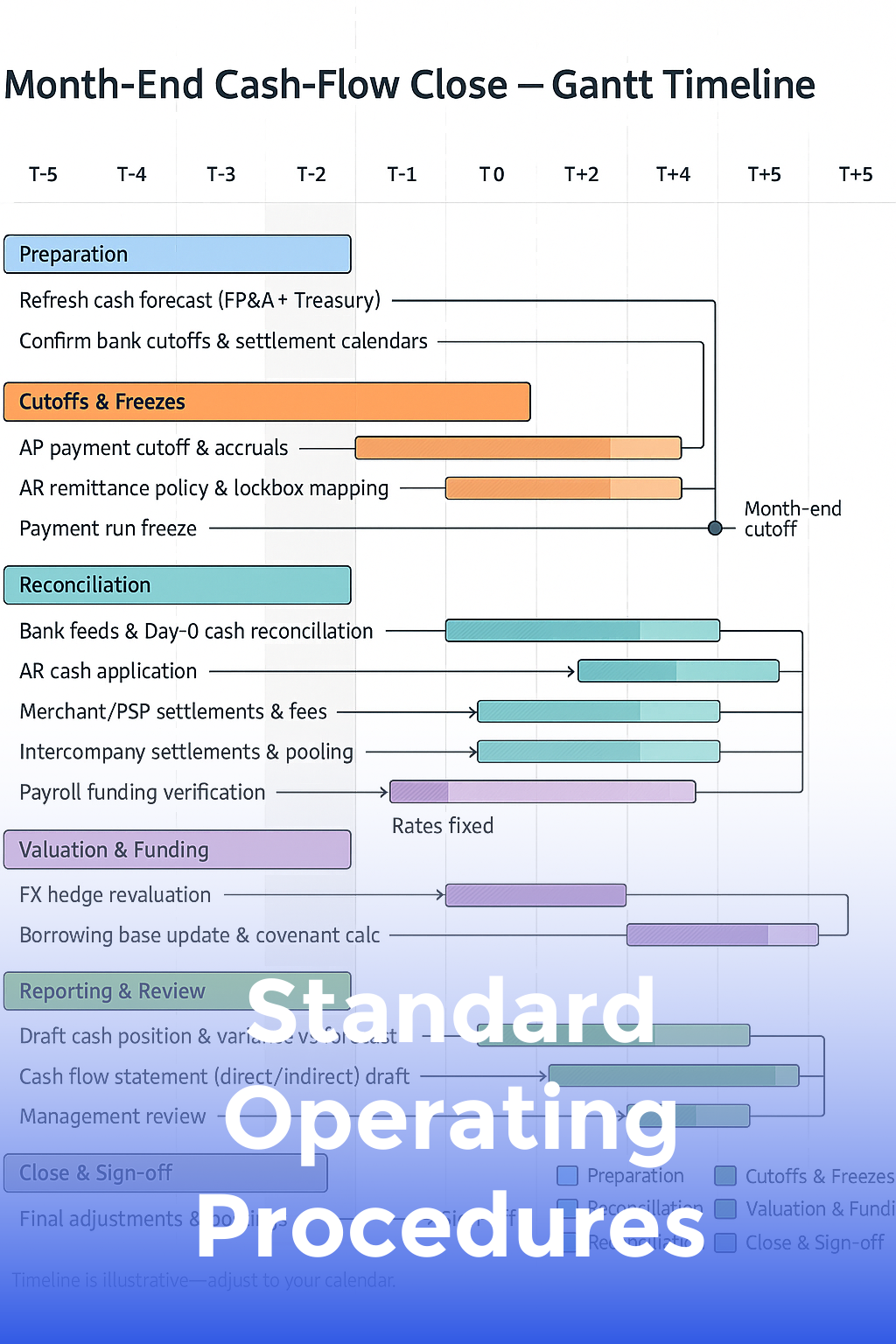

Standard Operating Procedures

Implement a month-end SOP with internal controls, sign-offs, and review checklists.

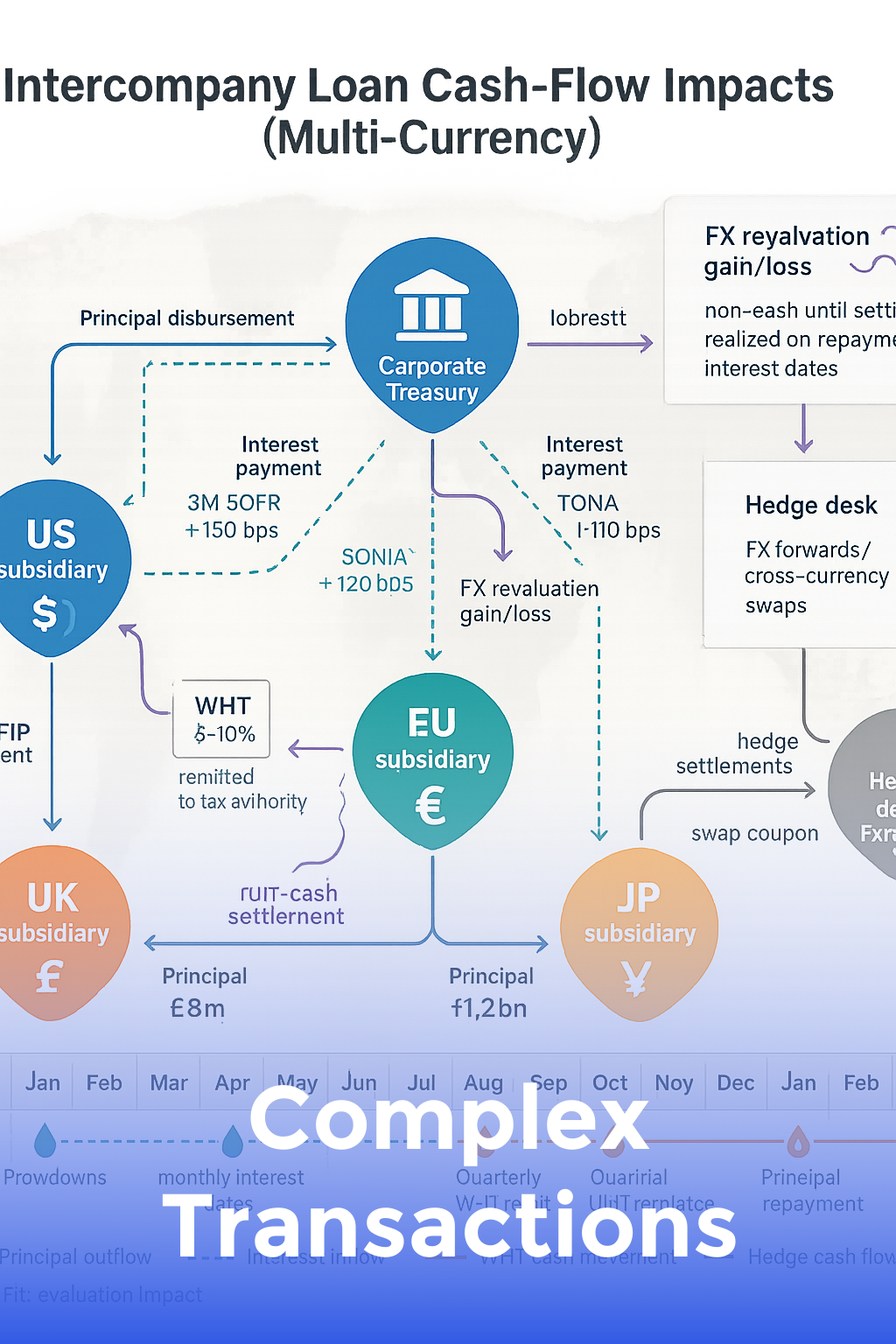

Complex Transactions

Handle foreign-currency, intercompany, and multi-plant transactions without classification errors.

TESTIMONIALS

What our students are saying...

" Our plant reduced month-end cash-flow prep from four days to one. The templates alone are worth the price. "

- Amanda Chen, Plant Controller

" Auditors had zero reclassifications this year—first time ever. This course made me the go-to expert at HQ. "

- John Doe

" As a cost analyst transitioning into accounting, the step-by-step lessons clarified ASC 230 in a way textbooks never did. "

- Roberta Johnson

MODULES

FOLLOW MY STEP BY STEP VIDEO TRAINING

ASC 230 Foundations

Grasp ASC 230 fundamentals and the three activity categories with manufacturing-specific examples.

Gathering Source Data

Extract and map data from ERP systems such as SAP and Oracle for cash-flow preparation.

Inventory & COGS Adjustments

Reconcile inventory, depreciation, and cost-of-goods-sold adjustments unique to manufacturers.

Direct vs. Indirect Method

Compare the direct and indirect methods and convert indirect data into a direct-method statement.

Standard Operating Procedures

Implement a month-end SOP with internal controls, sign-offs, and review checklists.

Complex Transactions

Handle foreign-currency, intercompany, and multi-plant transactions without classification errors.

Automation & Templates

Automate reconciliations with Excel, Power Query, and ready-made macros.

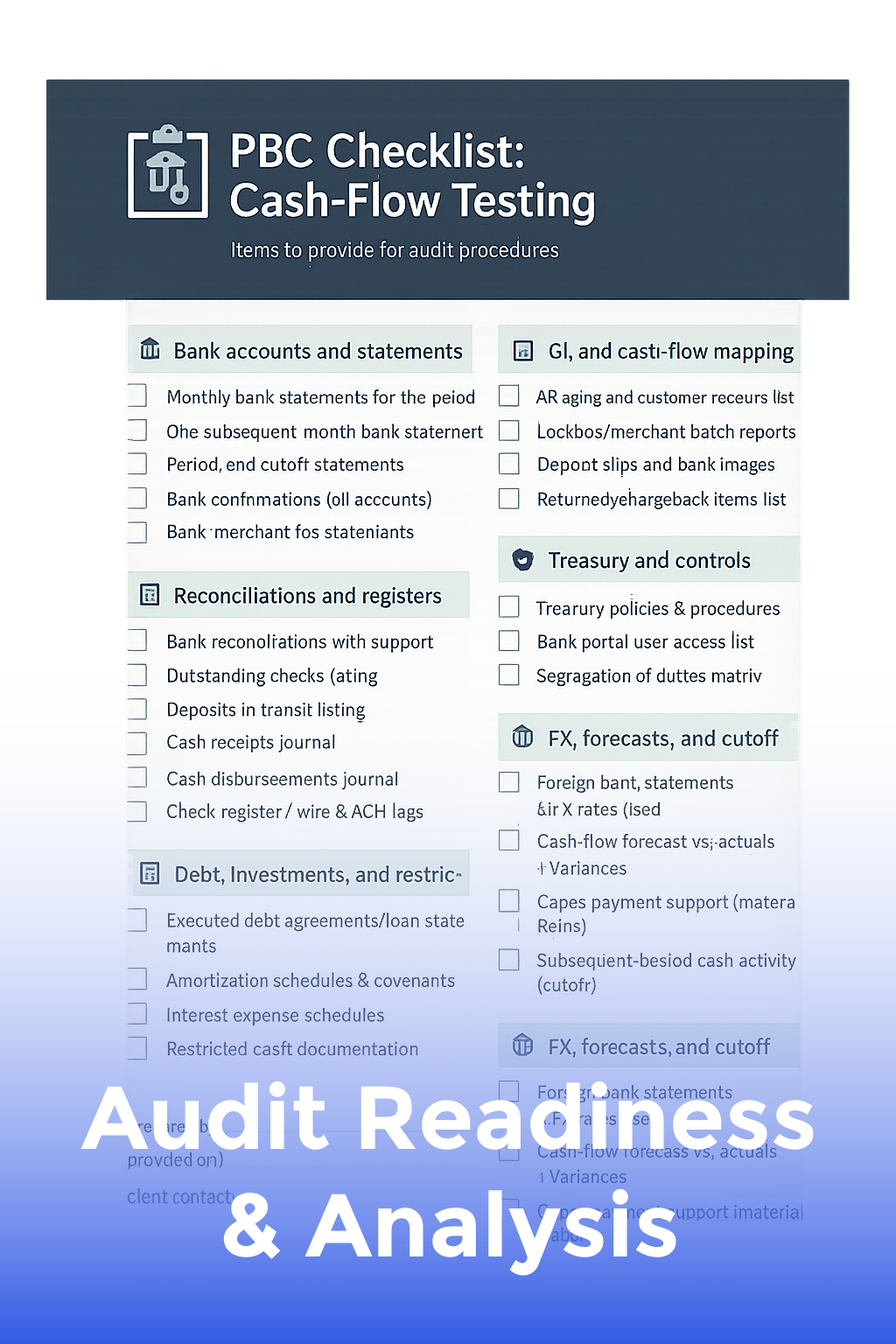

Audit Readiness & Analysis

Prepare for audits with variance analysis, disclosure notes, and common PBC requests.

4.9/5 star reviews

Become a Specialist in ASC 230 & Cash-Flow Statement Preparation

Gain hands-on expertise creating GAAP-compliant cash-flow statements for manufacturing operations with our step-by-step video and template-based course.

Here's what you get:

Immediate access to stream 25+ HD video lessons and downloadable Excel files.

Exclusive links to recommended ERP reports, macros, and reference guides.

Membership in a private Slack community for peer support and Q&A.

Lifetime access to future ASC 230 updates and bonus modules at no extra cost.

Today Just

$997 one time

"Best purchase ever!"

" Auditors had zero reclassifications this year—first time ever. This course made me the go-to expert at HQ. "

ABOUT YOUR INSTRUCTOR

Meet Ntianu

A CPA and former Big 4 audit manager with 20+ years of manufacturing experience who has guided Fortune 500 plants and midsize firms through complex ASC 230 compliance.

After watching countless controllers scramble each month-end to reconcile cash flows, he realized the industry needed a practical framework that blends ASC 230 rules with repeatable SOPs—so he built this course.

Graduates have cut close times by 50 %, eliminated audit adjustments, and earned promotions for becoming their plant’s cash-flow expert.

Led audit teams for multinational manufacturing clients at a Big 4 firm.

Served as Corporate Controller for a $1 billion manufacturing group.

Taught over 5,000 professionals through CPE-accredited webinars.

Contributor to the AICPA ASC 230 implementation guide.

Creator of a five-star-rated Excel template for direct & indirect cash-flow statements.

Founded a thriving online community for manufacturing finance leaders.

WHO IS THIS FOR...

Ideal for plant controllers, cost accountants, financial analysts, and anyone responsible for manufacturing financial reporting.

Plant Controllers

Cost Accountants

Senior Accountants

Financial Analysts

Manufacturing CFOs

Audit Managers

ERP Implementation Consultants

Accounting Students

STILL NOT SURE?

Satisfaction guaranteed

We want you to find value in our trainings! We offer full refunds within 30 days. With all of our valuable video training, we are confident you WILL love it!

STILL GOT QUESTIONS?

Frequently Asked Questions

Does this course provide CPE credits?

Yes—complete the final assessment to earn 6 hours of NASBA-approved CPE for Accounting.

What accounting background is required?

A basic understanding of journal entries and financial statements is recommended; no prior cash-flow statement experience is necessary.

How is this course different from generic accounting courses?

It is laser-focused on ASC 230 and manufacturing scenarios, providing ready-to-use SOPs, Excel templates, and real ERP data examples you won’t find elsewhere.

Enroll in the course now!

Copyrights 2024 | Manufacturing Cash-Flow Pro™ | Terms & Conditions